How food, agriculture, and land use will change

How food, agriculture, and land use will (have to) change to tackle the climate crisis

How food, agriculture, and land use will (have to) change to tackle the climate crisis

Accounting for 24% of GHG emissions today, this industry is on the verge of massive transformation. Let’s take a look from an investment perspective.

This is part of a series where I want us to have a detailed look into how each high-emitting sector can change to become regenerative. From an investment perspective, we will do it by looking at major problems, the technologies that could solve them, interplaying trends, and the investment opportunity size.

The sectors we will focus on in the series are 1. food, agriculture & land use , 2. energy, 3. transportation, 4. construction, and 5. manufacturing.

In this article, if not explicitly linked differently, all facts and figures come from Project Drawdown and the new IPCC special report on land use.

FALU is massively accelerating the climate crisis despite ongoing eco-efficiency efforts

Food, agriculture, and land use (FALU) is one of the most GHG intensive sectors: Three gaps are widening until 2050 if we continue business-as-usual and grow our species to 9.8 billion people:

- Food: we’ll need 56% more calories to feed our global population by 2050.

- Land: we’ll need an extra ~593m hectares, ~2x India, for that.

- GHG: we’ll emit 15 Gt CO2e per year just by agriculture and land use. This means that even if we eliminate all other human activities, warming will exceed 1.5°C.

Drastic and immediate consequences of climate change on food production are adding to that: Floods, droughts, changing climatic conditions, and new pests or weeds could kick in any time to make agriculture and land use even more problematic. Even more worrying is the proximity to tipping point scenarios and potentially irreversible impacts on some ecosystems.

Ongoing eco-efficiency improvements in FALU turned out to be short-sighted. Today, agriculture & land use alone account for 24% of GHG emissions.

The emission drivers are well understood.

The main problems in terms of emissions and destructive practices are well-known:

- Animal agriculture is hugely inefficient by wasting caloric, energy, and land resources. Our greed for meat also results in deforestation in other parts of the world that want to keep up with the supply of crops and cattle while burning their Amazonian treasures. Unless stopped, much of Amazon forests could desertify, releasing >50 Gt of carbon into the atmosphere in 30 to 50 years and triggering tipping points.

- Food waste: roughly a third of the world’s food production is never eaten. The involved resources, land, and GHG emissions are wasted for no reason. Food waste takes a quarter of all FALU emissions. That is more GHG than India emits, the top-three highest emitting country.

- Degenerative and inefficient farming degrades the land, deforests, and pushes excessive amounts of fertilizers and agro-toxics to nature and vulnerable communities. Unluckily, the progress in efficiency made so far and policy advances are negligible, even counterproductive. Furthermore, due to the dependency on the climate, food security is already at stake.

“An estimated 821 million people are currently undernourished, 151 million children under five are stunted, 613 million women and girls aged 15 to 49 suffer from iron deficiency, and 2 billion adults are overweight or obese.” — Special Report on Climate Change and Land, Chapter 05: Food Security

Although we know the problems, the policy keeps failing.

These problems are deeply interwoven and need systemic change. Around 40% of the EU budget is reserved for agricultural policy. Unfortunately, the EU has strong protectionism in place that works against climate and humanity. The European Parliament decided about this budget’s fate just a few weeks ago: EU’s agricultural policy won’t bring significant change in this defining decade.

We understand the problem and yet, we eat more meat every day, we create more waste, and drastic growth is on the horizon with large populations being lifted into wealth.

Let’s turn the three problem areas into solution areas and scale!

People are already much further than politics. FALU is arguably the most advanced sector regarding consumer awareness. This is reflected in lifestyle trends, such as going plant-based, zero plastic, regional, and organic.

And we can see the market kicking in: consumer-driven companies surge or adapt their offering appropriately. For instance, the traditional German animal product incumbent Rügenwalder Mühle grew its veggie alternatives to outperform its meat-based sales within six years.

Let’s shift gears and accelerate!

How can we leverage technology to reverse pressures on ecosystems and decrease greenhouse gas emissions while meeting growing demands for food and fiber? Three promising solution areas can be applied to the three problems described above to transform FALU:

- Plant-based proteins, precision fermentation, and cellular agriculture

- Food waste management and upcycling

- Precision, vertical, and regenerative farming

These solutions amount to an overall 204–274 Gt CO2e emissions reduction potential within the next 30 years. This means that if we manage to transform FALU, the 1.5-degree target is within reach!

Solution area 1: plant-based proteins and precision fermentation

Description

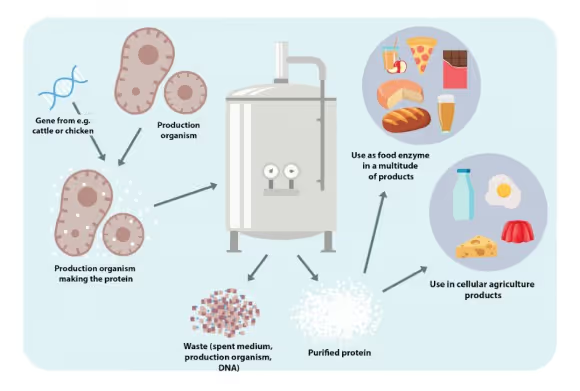

This solution area aims to offer products that are an order of magnitude more attractive than today’s products but without traditionally grown animal ingredients. That is, cheaper, tastier, or healthier, and at the same time more environmentally friendly, so that consumers can reduce their food footprint by buying what they love. This solution area consists of plant-based meat or dairy substitutes and precision fermentation, particularly cell agriculture that can grow real meat, fish, eggs, or dairy up to functional ingredients.

Regeneration-, market-, and GHG reduction-potential

The challenge of making plant-based proteins regenerative boils down to making farming and industrial processing regenerative (which I will cover in other sections and articles).

In contrast, precision fermentation/cell ag allows increased efficiency by using microbes instead of livestock for converting calories into protein and high-value molecules. This reduces pollutants, GHG emissions, water, and land use and allows a wider variety of feedstocks. This flexibility in feedstock and the full control of the chemical process enables decentralized production and upcycling of other biomaterials, which helps embed this technology into a circular system.

The market for alternative proteins is expected to be $140bn by 2030 and >$1trn by 2050. Add to that the demand for functional ingredients, which will grow to $127bn by 2030.

65–92 GtCO2e emissions reduction potential by 2050, according to Drawdown.

Tech enablers

Recent technology advances are mostly within the sphere of cellular agriculture. Companies and research institutions are progressing significantly in four fields: 1. optimizing strains for cell line development, 2. cell culture media, 3. improved bioreactors, and 4. scaffold biomaterials. Still, all these fields require significant breakthroughs to achieve scalability. While hurdles like going beyond fetal bovine serum as culture media might be overcome soon, without any breakthroughs, this media will still be responsible for up to 95% of the marginal cost of cellular meat.

The field is increasingly moving from academic collaboration to private companies and competition over the last years. Take Mosa Meat, for example, founded by Mark Post and his team that pioneered the first lab-grown burger at the University of Maastricht. Since then, they reduced costs 80x and raised a €47m Series B, fueling competition. Many startups have joined the race towards commercializing cell ag, e.g., cellular pork producer Meatable that bets on editing the cells and startups that only indirectly share the same body of research, focusing on fish (Finless Foods) or dairy (Legendairy Foods).

Not only tech but the policy race just got fueled by Singapore becoming the first country approving a cellularly grown product in December 2020.

The plant-based alternatives rely mostly on traditional technologies for production. Recent advances were primarily due to better designed industrial processes, e.g., AI-assisted recipe creation, such as Just or the Chilean NotCo that just raised $85m. Also, brand-building is an essential ingredient for successful startups, such as Oatly, the Swedish oat milk company, showed.

Market demand & investment landscape

The demand for alternative proteins has drastically changed over the last few years, in a feedback loop between more conscious consumers and companies offering better products. The plant-based meat is growing at 15.8% yearly, and the pandemic is accelerating that growth. Catalyzed by more environmentally and animal rights focused entrepreneurial pioneers, the traction and consumer demand is increasingly unlocking major corporations to invest in product development and acquisitions. The consumer food giants are Unilever, Nestlé, and Tyson Foods, to name a few. Still, also hidden champions like Bühler are heavily investing a bit deeper in the supply chain.

The venture investment landscape is increasing. In the first half of 2020, startups replacing animal products have raised $1.5b, a giant leap from total funding of $843m in 2019. The VC landscape is matured, with plenty of specialized VCs and more coming every year. This is also one of the few fields where Europe has arguably a strong VC landscape with Astanor, FrenchFood, and Demeter.

Recent interesting investments:

- Mosa Meat (NL, 2015), €47m Series B, led by Blue Horizon Ventures

- Ynsect (FR, 2011), €372m Series C, led by Astanor Ventures

- The Protein Brewery (NL, 2020), €22m Series A, led by Novo Growth

- Mushlabs (DE, 2018), €10m Series A, led by VisVires and Redalpine

- 3F Bio (UK, 2015), €7 Series A, led by Data Collective (DCVC), CPT Capital

Solution area 2: food waste reduction & upcycling

Description

There’s plenty of opportunities to ensure that food does not go to waste throughout the whole lifecycle. Food waste reduction can range from more intelligent logistics, warehousing, and supply chains to better demand understanding up to more resistant food products. Finally, there is an opportunity in upcycling food that is going bad and making that “waste” beneficial.

Regeneration-, market-, and GHG reduction-potential

Being conscious and efficient with resources and upcycling food is essential for a regenerative world — no doubt about that.

If we look at markets: food waste management will double to $60bn by 2030, whereas food upcycling will reach $80bn while also doubling in size from today.

Food waste solutions can reduce 87.45–94.56 GtCO2e emissions by 2050.

Tech enablers

Many tech enablers matured over the last years to enable better food waste management, such as AI, sensors, IoT & automation, fermentation, biotechnology, flow and microwave technologies for nutrients, and chemicals separation and extraction.

Startups such as Crisp bring real-time data insights to sync stakeholders across the supply chain. More bio-based companies such as Apeel or Mori increase the shelf life and dependency on cooling chains while decreasing chemical use for fruits and veggies leveraging bio-engineered coatings.

The B2C sector allows more community-based approaches, such as crowdfunded Sirplus consolidating and selling (almost) expired foods at lower prices. Similarly, Imperfect Foods for foods that don’t pass the visual QA towards retail.

Market demand & investment landscape

Primarily driven through eco-conscious consumers and activists, we have seen a surge in “ugly food” companies and established grocery chains incorporating ugly foods — community-based efforts such as food-sharing and companies taking part in that. Besides consumer awareness, there are also EU targets for 2023 that should halve food waste by 2030.

From a business perspective, the absurdity of waste’s cost-superiority in a non-circular supply chain got us here in the first place. However, demand-driven consumer-facing companies are the big players shifting interest to this market, such as Whole Foods making upcycled foods as their top 10 priorities for 2021.

So far, in 2019/2020, 1bn VC dollars were deployed to solutions in this area, which is more than a 4x increase to 2018/2019, mostly driven by US investments. Significant recent investments are:

- Crisp (USA, 2016), $12m Series A, led by FirstMark Capital.

- Mori (USA, 2016), $12m Series A, led by Acre Venture Partners.

- Apeel Science (USA, 2012), $280m Series D, led by GIC, Temasek, and Astanor.

- Imperfect Foods (USA, 2015), $72m Series C, led by Insight Partners.

Solution area 3: precision, vertical, & regenerative farming

Description

Precision farming means the iteration of agriculture towards 4.0., i.e., using technologies from IoT to drones to AI for improving agriculture in terms of resource efficiency, pesticide use, and productivity. Precision farming techniques play a role in both vertical and regenerative farming.

Vertical farming is leveraging technologies such as AI and robots for a new type of agriculture: fully engineered and highly optimized vertical farms. They include soilless farming techniques such as hydroponics, aquaponics, and aeroponics.

Regenerative farming means outsourcing the intelligence to nature and ecosystems. More ecological practices, almost by definition, bring better soil health, more resilient systems, and nutrient/water efficiency.

Regeneration-, market-, and GHG reduction-potential

Precision and vertical farming will allow existing small- and large-scale agriculture to become orders of magnitude more efficient, from production to distribution. The necessity for a fast change at scale will require their deployment. Vertical farming will become particularly important in a regenerative world by allowing full control and data access over the whole process while allowing hyper regionality — actual urban farming becoming a reality.

By 2030, the market for precision farming is expected to grow 5x to $22bn and for vertical Farming by 10x to $31bn.

This 360° photo shows this Ecosia reforestation project.

Regenerative farming is the more natural solution that we as Ecosians particularly romanticize, for a good reason: It’s the one most aligned with nature. Startups in this sector have yet to come up with scalable business models. This sector will primarily be financed through other asset classes than VC, but I hope to see exciting tech applications here as well.

Overall, solutions in this category have an emissions reduction potential of 49–82 GtCO2e until 2050.

Tech enablers

The technologies that position precision and vertical farming on the verge of high growth have become very mature, accessible, and affordable. This includes AI, automation, biotechnology, sensors, remote sensing, IoT, internet data coverage, Global Navigation Satellite System (GNSS), Variable Rate Technology (VRT), and drones. Further, precision farming is a real business case for most ag players today, independent of their sustainability strategy.

For instance, Israel-based Taranis applies image data from drones and satellites to allow much better crop management. This allows identifying needs for attention in real-time on a per plant level, be it a disease, insects, weeds, or nutrient deficiencies.

Regenerative farming relies more on nature-based processes. Its practices have recently benefited from an increasing community-driven approach and ecological farmers sharing knowledge and experimenting with concepts based on permaculture, agroecology, agroforestry, or no-till. Combine this with precision tech to create modern regenerative agriculture with remote sensing, big data, etc. This way, we could ultimately lift this from its connotation of being a hippie dream to a serious food production alternative.

Market demand & investment landscape

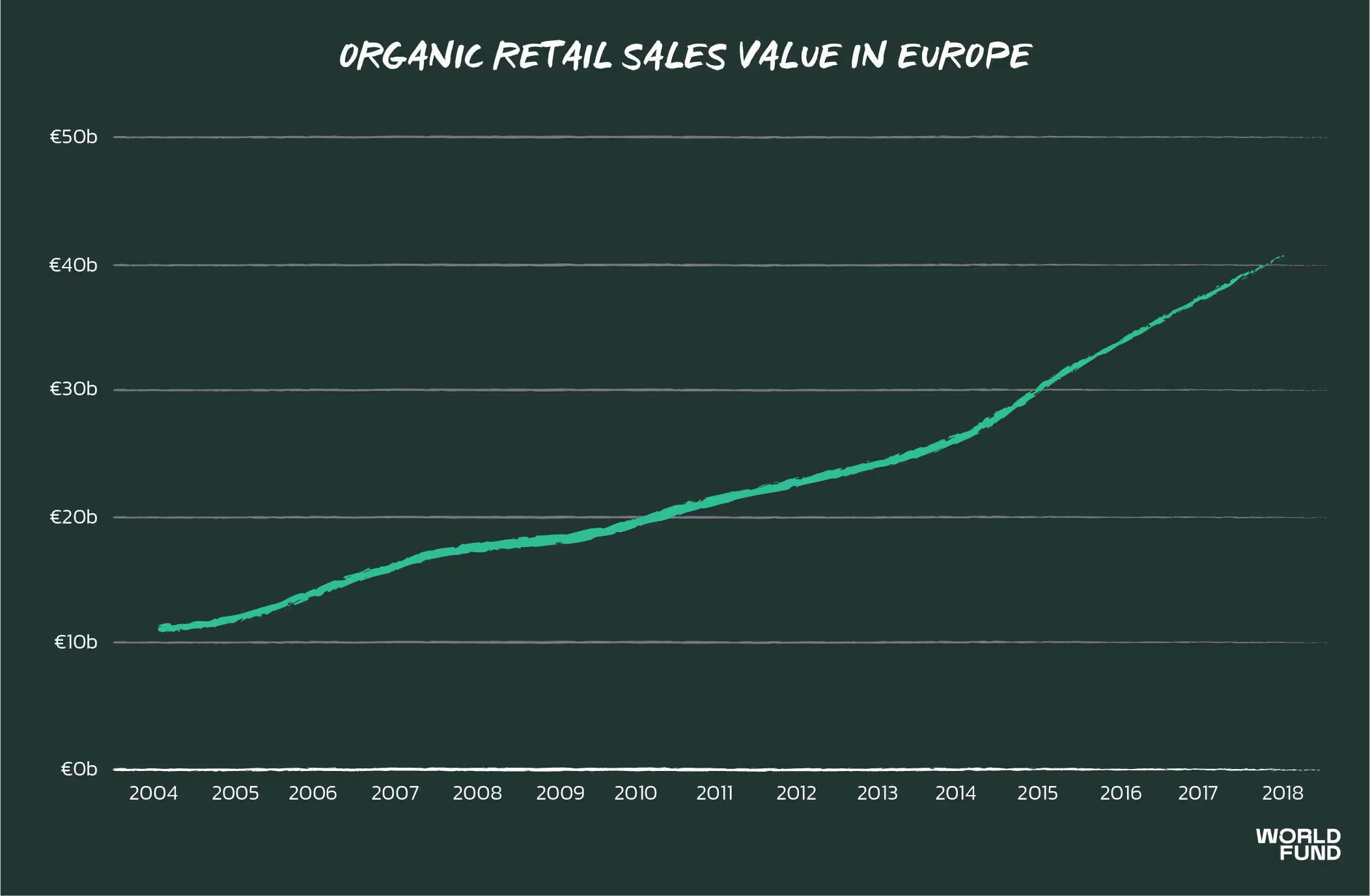

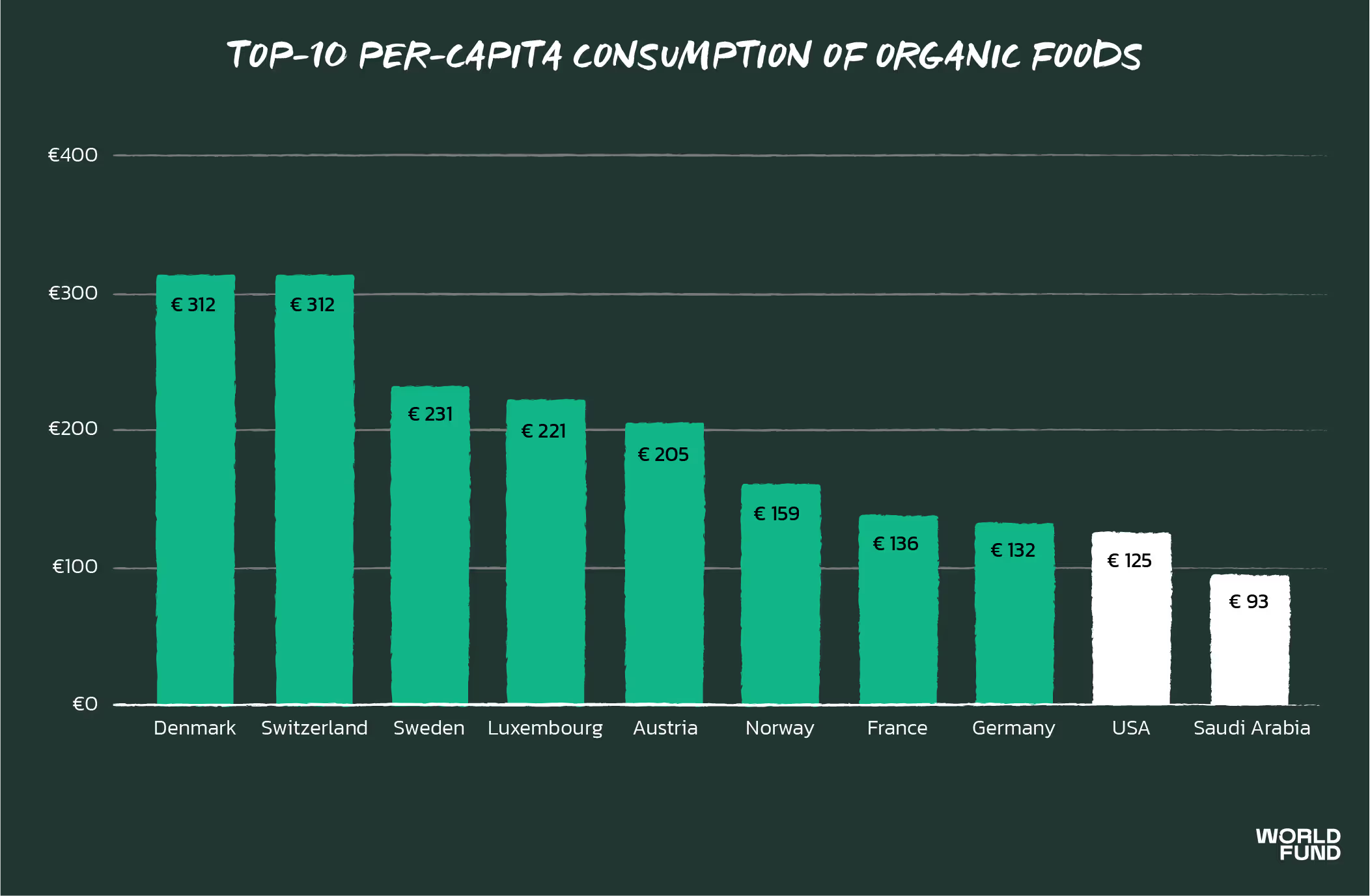

We have seen a significant surge in consumer demand for more organic and regenerative food supply practices. Despite premiums of up to 150%, the average European consumer increases their organic food consumption by 13.4% yearly. In 2018, Europe surpassed the €40b mark — the eight countries worldwide where consumers pay most for organic foods are here.

Precision and vertical agriculture have seen many deals over the last years, even though with a tendency to smaller ticket sizes. Out of the $2.8b poured into these startups, a significant share of 70% goes to later-stage deals.

These sectors have created the first unicorns with Plenty, Gingko Bioworks, and Indigo. Here are some interesting investments in Europe & Israel:

- Infarm (DE, 2013), €170m Series C, led by LGT Lightstone, Atomico, Astanor.

- iFarm (FI, 2017), €4m Seed, led by Gagarin Capital Partners.

- Taranis (IS, 2015), $30m Series C, led by Temasek.

- Dendra Systems (UK, 2014), €10m Series A, led by Airbus Ventures, At One Ventures, Future Positive Capital & Lowercarbon Capital.

Let’s bring the solutions to market and counteract the disastrous impact our food system has

With the recent EU CAP vote against stricter climate-relevant regulations for the ag industry, we can expect many unsustainable practices to continue from big ag. However, the market, profit, and impact potentials are gigantic. Let’s turn FALU from a heavy climate burden to a regenerative sector, helping us save humanity.

Note: What do I mean by regeneration potential? Sustainable is not enough. We need to go beyond. The word "sustainable" has deteriorated to describing the bare minimum to survive the crisis. Instead, we should aim to qualify every solution we bet on with its potential to fit a vision of a regenerative world. Such a vision includes full circularity (i.e. no net-extractive operations), our society strives within ecological boundaries, abundant supplies of renewable energy, fully accountable companies, and closed gaps of inequality. I will likely elaborate on this in a future article to provide more context.

.svg)

.svg)

.jpg)

.svg)