The State of European Tech

“The State of European Tech” — what the report means for Climate Tech

Every year, Atomico publishes its widely anticipated “State of European Tech” report. Its focus: startups, VCs, and LPs. They just published the 2020 report. I had a look at the data to understand what it means for our climate tech ecosystem. Here are three theses.

Expect Climate Unicorns: European venture capital will significantly grow towards climate tech

The report shows that Europe has what it takes in terms of entrepreneurial competence, plus the VC money speaks for itself. This will be a fruitful combination of a policy landscape with climate goals and strong R&D support in place.

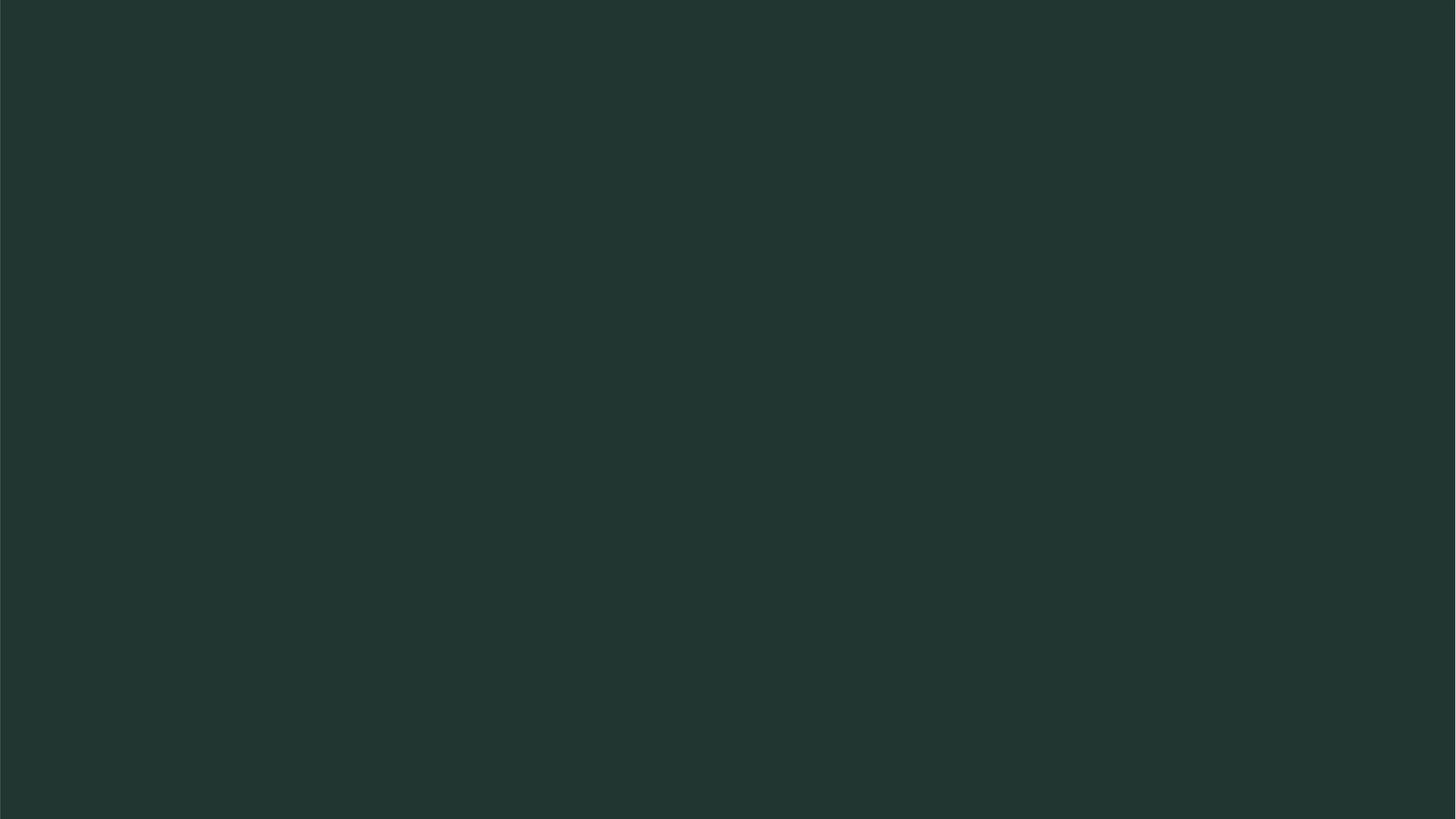

The 208 unicorns (18 just in 2020) that Europe has produced come from 40 different towns and cities in 24 countries, indicating a strong and distributed competence. And in fact, Atomico did a cohort analysis to create a fundraising funnel seen below. One in a hundred seed-funded startups can expect to become a unicorn, which are slightly better chances than for US startups.

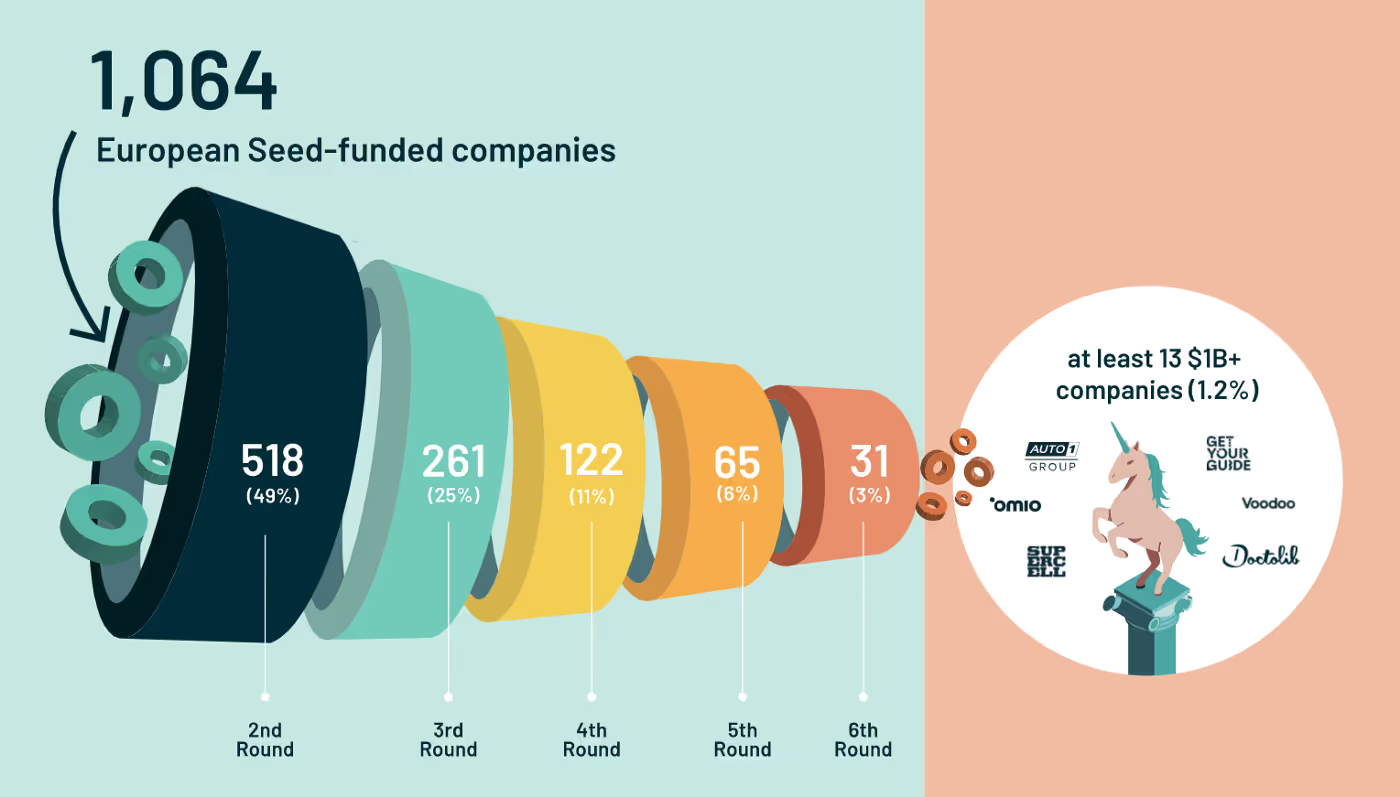

We can see among purpose/SDG driven startups that climate investments take a significant share with 29% ($11b) invested since 2016. To be fair, spillover effects, i.e. SDG 13 (climate action) being interwoven with other SDGs, allowing for double counting and maybe skewing this data a bit, but for exactly that reason, we can also expect it to grow further. Nine of the ten purpose mega-rounds in 2020 focus on climate action.

LPs are also starting to apply pressure: 45% require GPs to report on their portfolio’s ESG impact, and a further 41% are considering it. Maurizio Arrigo, Head of Private Equity at Pictet, comments the report with their assessment framework: “what is the commitment of the GP towards ESG; how ESG is taken into considerations in the investment activity; how does the GP report its ESG activity to LPs. We provide feedback to the GP based on our assessment and how they compare within our internal benchmark.”

We will see a wave of large European corporate acquisitions

What do you see if you look at the exit landscape of European unicorns?

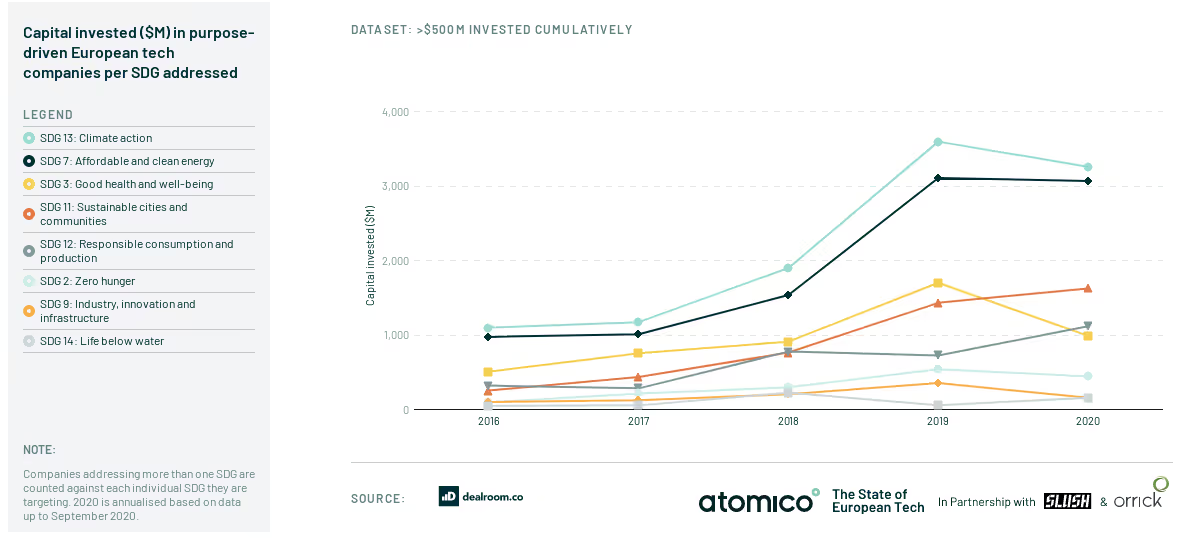

Only 4% of value arrived in European companies, with 14% going to US companies.

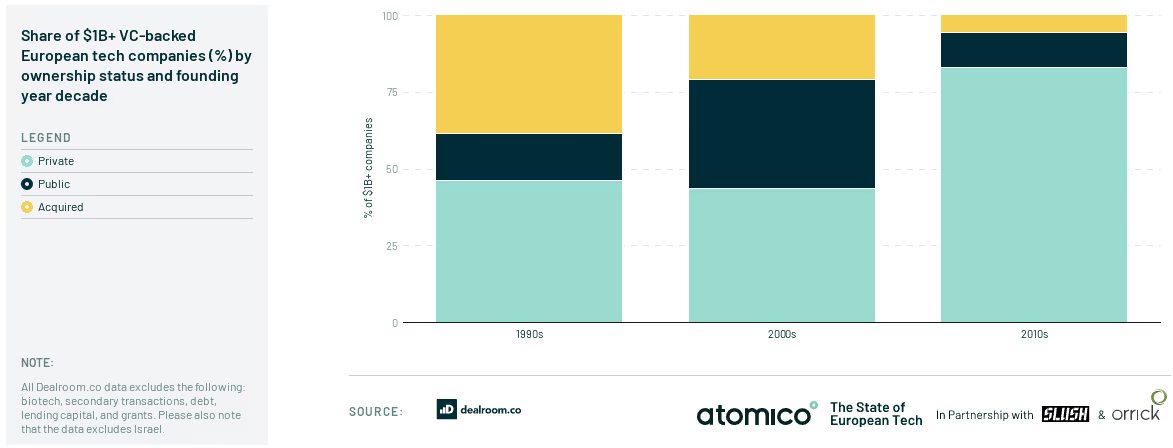

European buyers tend to prefer smaller valuations, which account for >90% of their transactions. While European buyers make the most deals, North American buyers have the highest share in total exit value with 59%.

In Europe, asset managers have big pressure to diversify, and so do European corporates. Particularly hard-to-decarbonize industries such as cement, oil & gas, steel, etc., are fighting to invest and save their future. Add that up with the 83% of unicorns founded in the last decade that still are private. “Liquidity is a key concern for VC investors globally as companies remain private longer and growth capital is increasingly available for companies willing to scale and preserve their independence.” as Xavier Coirbay from Sofina Group adds to the report.

Europe will finally harvest its academic and entrepreneurial successes and be in charge of building its regenerative economy

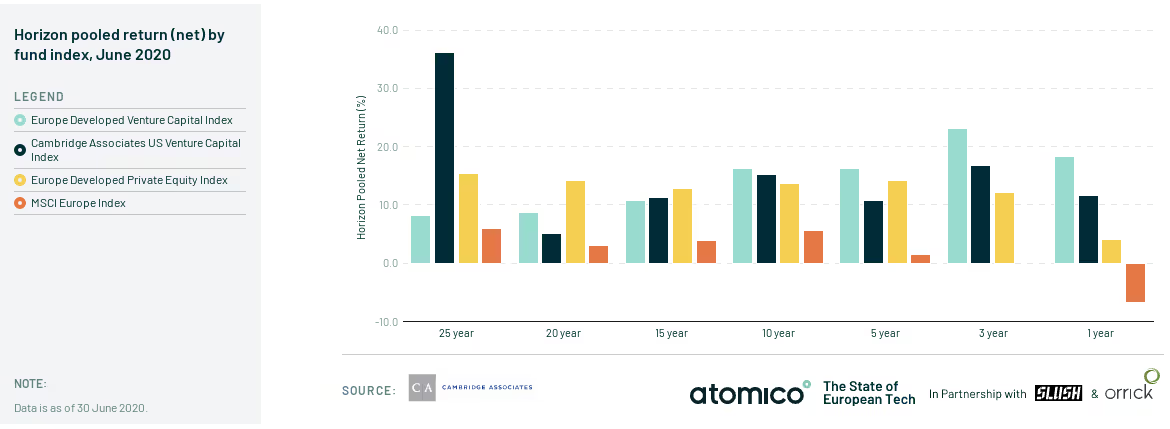

European VC has performed better than US VC over the reporting periods 1, 3, 5, and 10 years. Not only that, in these periods, it also beat the Europe PE index and the MSCI.

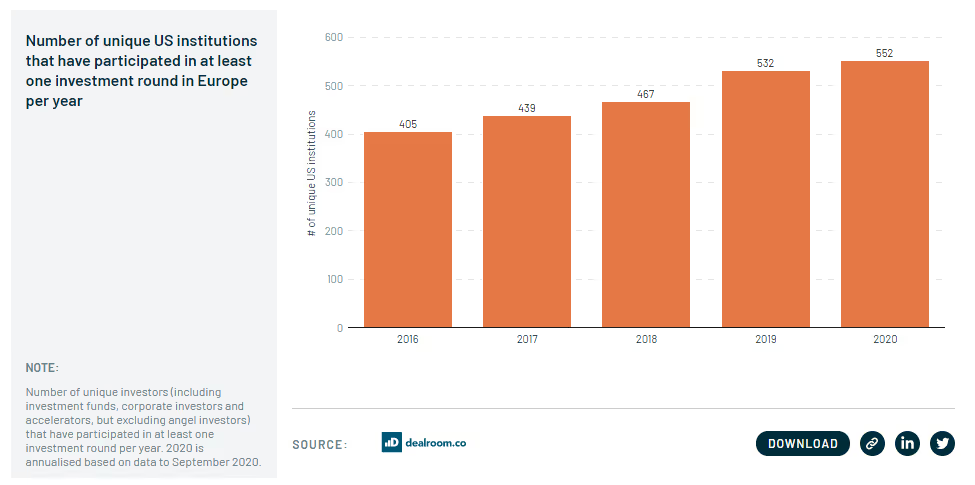

Despite this performance, a funding gap remains. Therefore, more and more US institutions are flooding over to European investment rounds: 552 already — an increase of 36% since 2016.

This is particularly true for later-stage rounds because European investors don’t bring sufficiently deep pockets.

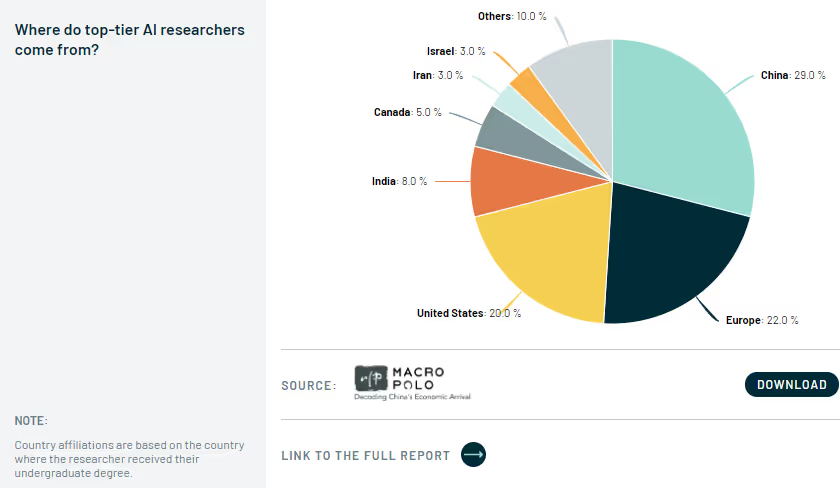

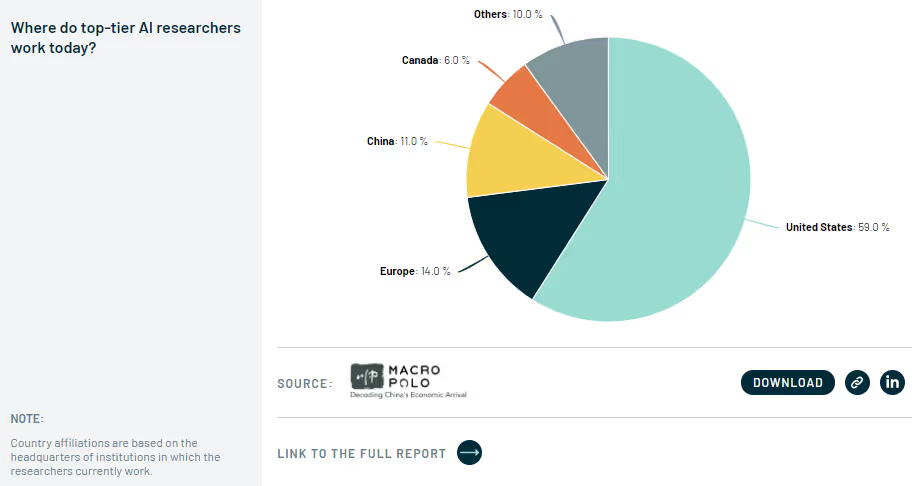

Furthermore, the excellent results of Europe’s heavy investments in education and scientific competence seem to leak. Exemplified in top-tier AI researchers: 22% of them study in Europe, but only 14% work here — a leakage of ⅓.

To put it in the words of Steve O’Hear from TechCrunch:

“People don’t talk much about technology sovereignty, but if recent events have taught us anything, it’s that geopolitics is getting more not less volatile, and as a European, I’d feel a lot more comfortable if we not only developed but owned more of the future too.”

What does that mean?

So I’ve read the report with a particular focus on climate tech, there’s obviously much more information in there. But putting this data together showed me that there’s much reason to be hopeful for reversing climate change, but we need to step up our VC game in Europe. This could become the biggest opportunity in history.

If you’re interested in European climate tech as an investor or entrepreneur, please reach out to me!

.svg)

.svg)

.jpg)

.svg)